Payday Super (Without the Chaos): Your Practical Guide

From 1 July 2026, the Australian Government’s Payday Super legislation transforms superannuation from a quarterly task into a payday obligation. For shift-based businesses, this means super must be paid and reported at the same time as wages. This reform introduces significant changes to your regular payroll cycles and cash flow management.

Our Payday Super Checklist helps you get ahead of these changes by guiding you through necessary system audits, cash flow adjustments, and compliance updates.

Our Payday Super Checklist helps you get ahead of these changes by guiding you through necessary system audits, cash flow adjustments, and compliance updates.

TRUSTED BY 385,000+ WORKPLACES ACROSS THE GLOBE

Get the checklist

TRUSTED BY 385,000+ WORKPLACES ACROSS THE GLOBE

This checklist covers:

An overview of the Payday Super changes

Checklist to help you get your business Payday Super ready

A quick step-by-step action plan to get your team preparing for the changes

Checklist sneak peek

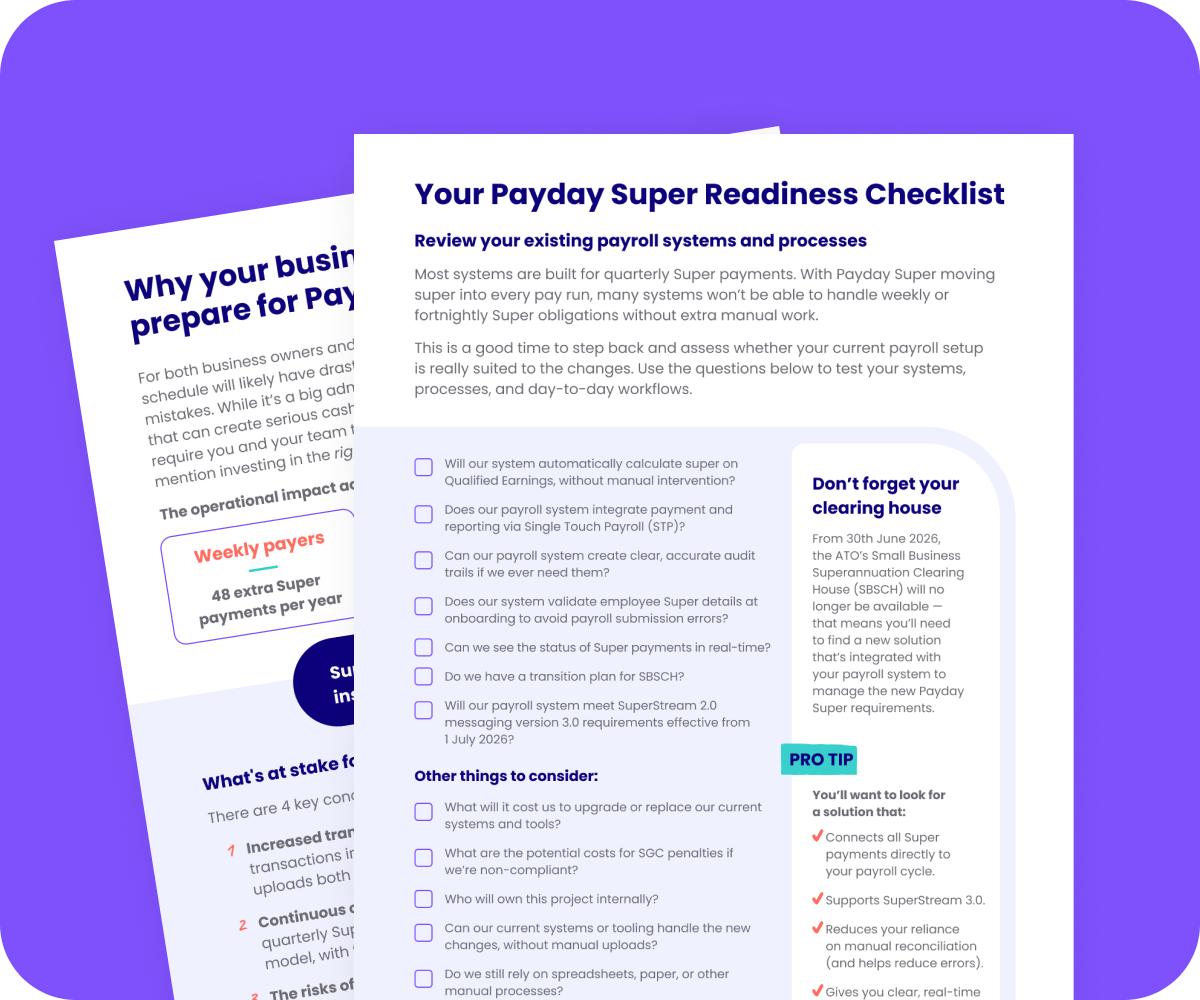

This guide provides a comprehensive breakdown of the four key concerns every business must address: increased transactional volume, continuous cash flow management, the risks of manual systems, and heightened scrutiny from the ATO.

The checklist includes actionable steps for strengthening your internal approval processes, financial buffers, and tips on how to communicate these changes to leadership and employees.

Join over 385,000 workplaces scheduling on Deputy.

756+ glowing reviews on Capterra

TRUSTED BY 385,000+ WORKPLACES ACROSS THE GLOBE