How to calculate Cost of Goods Sold

Cost of goods sold is all the costs that are involved in producing and selling a product.

You calculate your cost of goods sold by adding your beginning inventory to your purchases and subtracting the ending inventory for a specific period.

Downloadable Calculator for Cost of Goods Sold Formula

Download the calculator below that can simplify the process of calculating Cost of Goods Sold by allowing you to plug in your values and come up with your calculation.

Beginning inventory + Purchases – Ending inventory

Before you can work out the cost of goods sold for your company, you need to know the following:

How to value your inventory – You need to make a decision about the method you use to value your inventory. You can choose to value your inventory at cost, lower of cost or another way. You have to value your inventory at cost if your business uses the cash accounting method. You must check with your accountant, bookkeeper or anyone else who prepares your taxes if the ways you work out costs, quantities or valuations of your products have changed. If there have been changes, you must incorporate explanations for these modifications when reporting your tax. You should seek advice from a financial professional about the best valuation method to use.

What is your beginning inventory – Your beginning inventory is the entire cost of every product in your inventory at the start of the year. This figure should match the inventory at the end of the last year. Where there are discrepancies between your beginning inventory and your inventory at the end of the last year, you will need to give an explanation for tax purposes.

What is the cost of your purchases – You need to find out the total amount of each and every product you bought throughout the year that was included in your inventory to be sold. You must subtract products that were for your personal use. If your company is the manufacturer, you need to incorporate the total cost of every raw material and item you bought throughout the year

What is the cost of labor – Your cost of labor consists of your company’s cost for the employees who work specifically to make your goods and products from raw materials and parts. Cost for finance, sales, marketing, administrators, etc. are excluded from this cost of labor calculation.

What is the cost of materials and supplies – These costs must be specifically associated with making your goods or products.

What are your other costs? – Your other costs include overhead expenses for rent and utilities for the premises where the goods or products are being made or assembled. It also includes freight on materials, supplies and shipping container costs.What is your ending inventory – You will find your ending inventory by working out the total value of every item in your inventory at the end of the year.

Now that you have all the information you need, here is how to work out your costs of goods sold for an individual product:

1. Understand the cost of goods sold formula

As stated above, the cost of goods sold formula is as follows:

Beginning inventory + Purchases – Ending inventory

The cost of goods sold formula can be broken down as follows:

- Find out your beginning inventory costs (at the start of the year).

- Add further inventory cost (what you bought throughout the year).

- Subtract ending inventory (at the end of the year).

To get a true picture of the cost of goods sold, you must add all the additional products you purchased during the specified period. Because you are only concerned with the cost of the inventory sold for a specified period, you need to take away the ending inventory and this will leave you with only the inventory that has been sold.

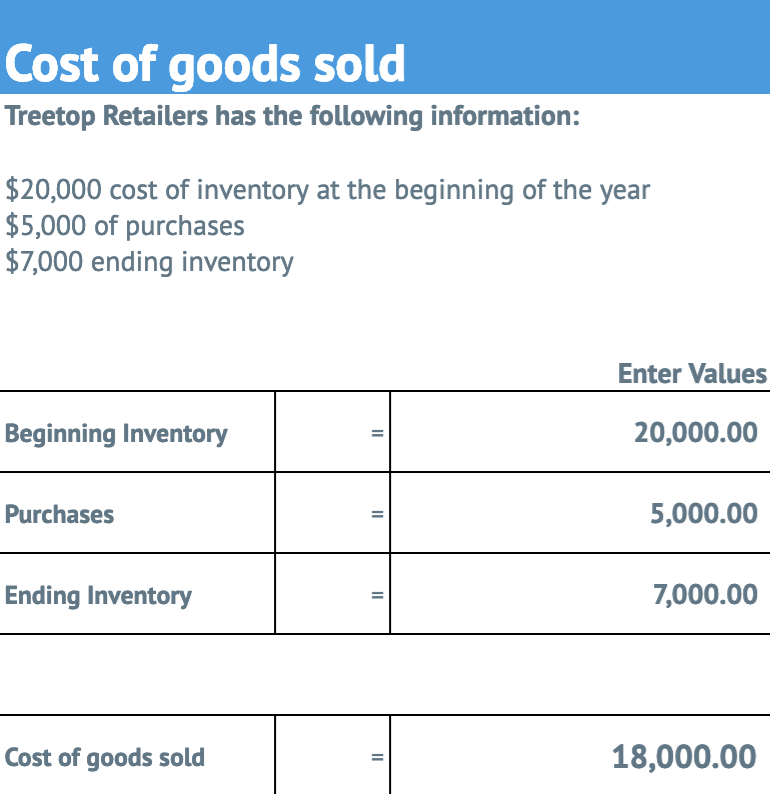

The following is an example of the cost of goods sold calculation.

If you own Treetop Retailers and you have:

- $20,000 cost of inventory at the beginning of the year.

- Add: $5,000 cost of further inventory you bought throughout the year.

- Subtract: $7,000 ending inventory.

Treetop Retailers cost of goods sold is $18,000.

Click below to download the template and add your figures to come up with the calculation of your cost of goods sold.

The table below shows a representation of the above:

You can use this calculation to subtract the costs of your products that you have for sale, whether you buy and re-sell or manufacture them.

The following are two types of costs that are included in the cost of goods sold:

- Direct costs – These costs are associated with producing or buying the products.

- Indirect costs – These costs are connected to labor, facilities, equipment, and warehousing.

2. Work out your direct costs

Direct costs include:

- Cost of raw materials.

- Cost to buy goods to be resold.

- Cost of packaging.

- Costs that are directly related to producing your goods, for instance, rent for the place that the product is manufactured.

3. Find out your indirect costs

Indirect costs include:

- Storage costs for your products.

- Labor cost for workers involved in producing the product.

- Depreciation costs of the equipment that is used to make, package or store the product.

- Cost of the equipment that’s used for administrative work (this does not include production).

- Wages for managers or administrators who supervise production.

4. Establish the cost of facilities

It can be challenging to work out your facility’s costs without the advice of a qualified accountant. Your accountant will assign a specific percentage of your facility’s costs, which include mortgage, rent, utilities, etc. to each product. Facilities costs need to be done for the period you are accounting for.

5. Decide on your beginning inventory

The following needs to be included in your inventory:

- Raw materials.

- Work in progress.

- Merchandise in stock.

- Finished products.

6. Add the purchase of inventory items

This includes all of the additional inventory you have bought throughout the year. It’s important to keep a clear record of every shipment or the entire cost of manufacturing of each and every product that is added to your inventory. If you have bought products, you must retain invoices and other relevant paperwork. Where your business makes items, your accountant will help you in relation to identifying the costs to be added to your inventory.

7. Settle on your ending inventory

You can work out your ending inventory by conducting a physical inventory of your products.

If you have inventory that is worthless, faulty or obsolete, you can reduce the inventory costs for these items.

- If a product is faulty, you need to report its estimated value.

- Where your inventory is worthless, you must have evidence to prove that the product has been destroyed.

- If a product is obsolete, you need to show confirmation that there has been a decrease in its value.

8. Calculate the cost of goods sold

You can seek assistance from an accountant or use a spreadsheet to work out the cost of goods sold.

Choose your valuation method

With the advice of your accountant, you can choose from two main methods to work out your cost of goods sold:

FIFO (First in, first out) – With this method, it’s assumed that the first item you add to your inventory will be the first item that’s sold. Therefore, the inventory at the end of a specified period will be made up of products that have been most recently added to your inventory.

LIFO (Last in, first out) – With this method, an assumption is made that the last item that has been added to the inventory will be the first one that will be sold during the accounting period.

What is the cost of goods sold?

The cost of goods sold is an expense of doing business and is the costs associated with the products that a distributor, manufacturer or retailer has sold. You need to report your cost of goods sold on your income statement. The costs of goods sold should take into account all the costs that are used to make a product that you sell.

If you have a service-based business, your cost of goods sold will include payroll, taxes, labor costs and employee benefits.

It’s important to calculate your cost of goods accurately because this figure must be reported on your tax return. After you have worked out your cost of goods, you can create a cost of goods sold budget to find out how you can make savings in relation to the sale of your products.

When working out the cost of goods sold, you must report the cost of your inventory based on how much it cost to make, or the price you paid for it, and not how much it cost to sell. If the price of the products your business sells fluctuates throughout the year, you need to work with your accountant to determine how you will report these differences, in a way that the IRS will accept.

Your accountant should be aware of the different techniques that are acceptable to the IRS when dealing with changes in the cost of your goods during the year.

Due to the specific tax rules around cost of goods sold, it is advisable to consult a qualified financial professional before you start to determine the cost of different elements, like labor, materials and purchases. Your tax advisor will assist you in following the rules of your chosen accounting method of calculating the cost of goods sold.

The cost of goods must be included on your business tax form and applies whether you are a sole proprietor, in a partnership or operate a C corporation. In order to assist your accountant and make your life easier, you should keep the relevant records. These records will help you calculate your cost of goods accurately and will also provide evidence that you have complied with the rules set out by the IRS. You also need to remember to keep your personal and business expenses separate when working out the cost of goods sold.

The cost of goods sold is an important financial metric because it provides insight into one of your largest business expenses – your products. In certain situations, you may also be able to reduce your taxable income when reporting your cost of goods sold.

Now that you have a fundamental understanding of how to work out the cost of goods sold, you can turn your attention to streamlining another large business expense, your labor cost.

Failing to keep a tight level of control on your labor cost could have disastrous consequences for your business.

Use Deputy to streamline your staff scheduling and to make decisions that keep your business covered with the right number of staff.

Sign up for a free trial by clicking the link below (no credit card required!) to find out why businesses like Nike and Amazon trust Deputy to schedule their hourly staff with ease and efficiency.