New: Update to Salary Allocation in Deputy

There’s no denying that when running a business, the cost of labour is the largest expense. As labour costs continue to rise, budgeting for labour in a growing business can be a challenge.

But first, what is labour costing and why is it important?

Labour costs include all direct and indirect costs associated with employing your staff. Direct labour costs refer to the sum of all employee wages, employee benefits costs and paid time off for those who are directly involved in producing the goods and services available for purchase. On the other hand, indirect labour costs include all other labour costs that aren’t necessarily attributed to producing goods and services but enable the direct labour force. For example, security guards are commonly considered as an indirect labour cost.

At Deputy, we’re passionate about helping you grow your business and that means helping you get more control over your costs – more specifically, your labour costs. Being a popular request for improvement, i’m excited to take you through how our new salary allocation update will help you get a grip on your labour costs.

Three New Ways To Allocate Salary Labour Costs in Deputy

Over the years we’ve learned that budgeting for labour costs can be a challenge for any business, but it doesn’t have to be that way. To help make business decisions and drive growth, precise reporting is vital – and that’s where we can help. When it comes to allocating labour costs, we’ve got just the right option for you.

So, let’s dive right in.

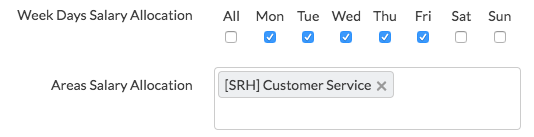

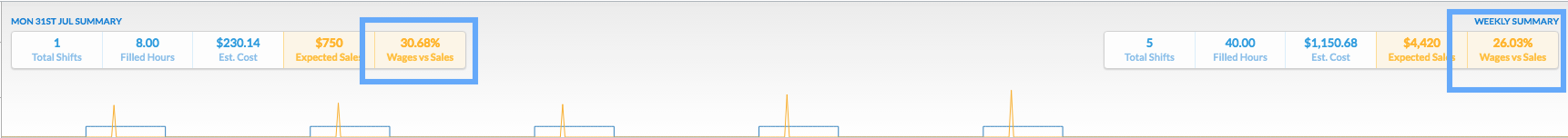

1. Days of the Week

Using this option, you can allocate salary staff costs to a particular cost centre in your business for fixed days of the week. This option is best used when your staff work typically the same days, week to week.

For example, Hannah who leads the Customer Service team at our Surry Hills office works a 40 hour week Monday through to Friday. By selecting days of the week salary allocation, Hannah’s wage costs are portioned equally from Monday through to Friday.

By entering sales revenue in Deputy, we can forecast labour efficiency using the Wages v.s. Sales ratio.

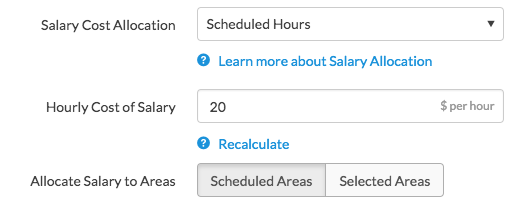

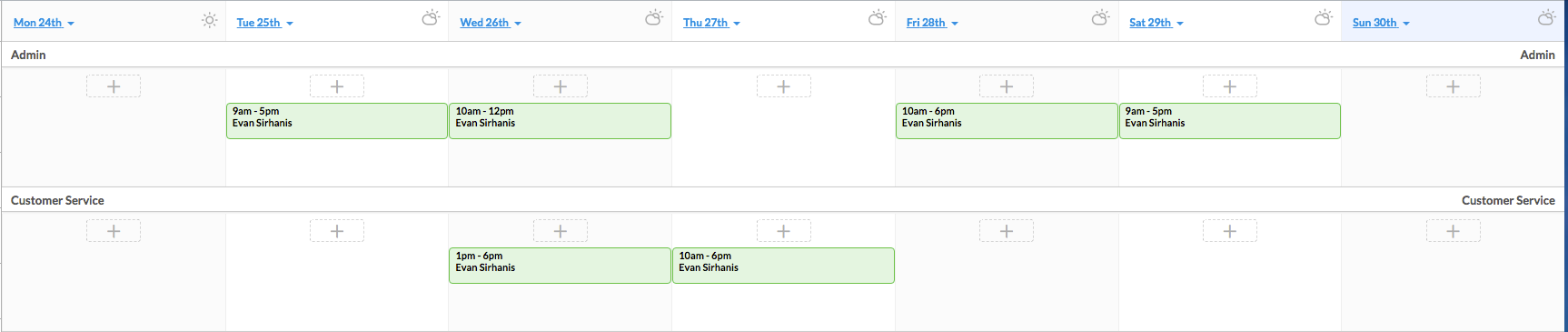

2. Scheduled Hours -> Scheduled Areas

Our Scheduled Hours -> Scheduled Areas allocation option will distribute salary wage costs according to where you schedule your staff, and is best used for staff who work in multiple areas of your business. For this option to work successfully, you’ll need to ensure that you schedule your staff in the appropriate areas.

In the above example, Evan’s scheduled to work with the Admin team for 24.5 hours and with the Customer Service team for 13.5 hours. Therefore with this option enabled, Evan’s salary cost will be allocated to both the Admin and Customer Service cost centres for 24.5/38 hours and 13.5/38 hours respectively.

This gives us a better representation of labour costing per cost centre and hence, now we can accurately forecast business performance.

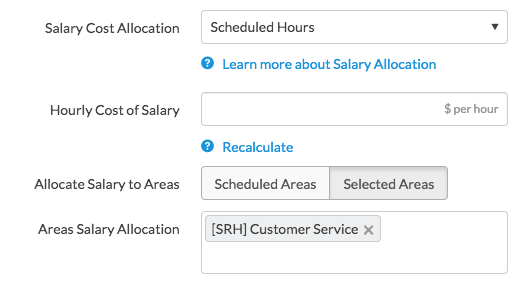

3. Scheduled Hours -> Selected Areas

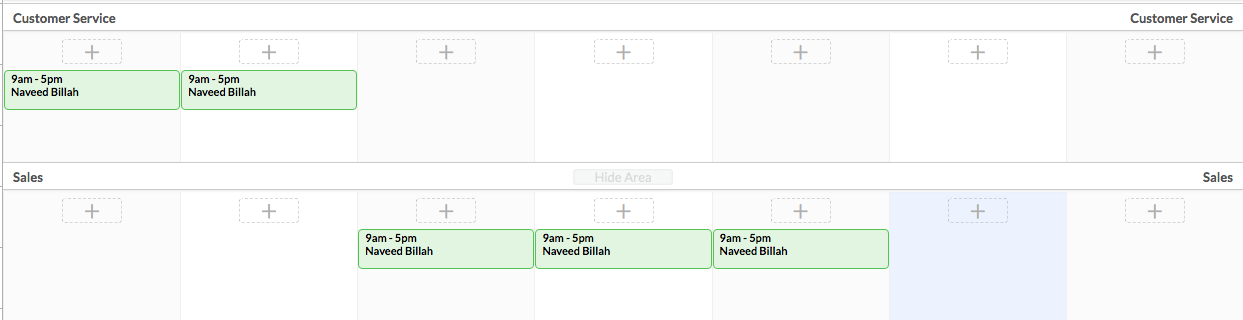

Alternatively, selecting Scheduled Hours -> Selected Areas allocation is best for when your staff work in multiple areas but you need to allocate their cost to a specific cost centre. With this option enabled, your staff’s wage costs will be apportioned according to their scheduled hours and allocated to the specified cost centre/s.

To put this into context, in this example Naveed, who primarily works in the Customer Service team, is scheduled to close deals himself this week rather than working alongside them to win deals as he usually would. Regardless of where he’s working, his salary cost will be allocated to the Customer Service cost centre providing us with a reliable cost by department.

We can now make changes to the schedule with confidence knowing that my costs are accurately accounted for. This allows us to make informed scheduling decisions to help me improve my bottom line.

For more information on how you can get control over your labour costs, you can refer to our salary allocation help guide.

How Deputy Gives You Complete Visibility Over Your Labour Costs

We understand that employing staff not only involves paying their wages, but also includes paying a range of on-costs associated with the hire. For example, superannuation and worker’s compensation are additional on-costs that give a more accurate picture of total labour costs. Each of these costs may seem small initially, but, they add up when employing a complete workforce.

We’re here to help you take that into account so that you can budget accurately and publish the most cost optimised schedule.

With our latest updates to labour costing applied with Deputy’s on-cost percentage, we give you complete visibility over your labour costs.

Deputy’s on-cost calculation has allowed me to truly see the reality of labour expenditure. Super, annual leave, sick leave, worker’s compensation all now taken care of. With true costs being reflected in Deputy, it has allowed me to empower my managers to create a roster that is within budget. With Deputy I see the big picture. I’ve gone from 390 hours per week down to 350 hours by using this amazing service – Deputy Customer

Over To You

At Deputy, we’re passionate about helping you grow your business which means getting a grip over your costs. Whether you want labour costs spread across certain days of the week or according to where you schedule staff, with our new labour cost allocation options you can take labour budgeting to the next level.

We’d love to hear from you, our awesome customers, on how Deputy can continue to help you with growing your business and correctly tracking your costs. If you have any questions or concerns regarding this update or need a hand getting started, don’t hesitate to leave a comment below or reach out for help.

Get started with labour costing and salary allocation today!